A financial advice columnist shared her horror story of being conned out of $50,000 in an elaborate Amazon scheme, warning readers these scams could happen to anyone.

“When I’ve told people this story, most of them say the same thing: You don’t seem like the type of person this would happen to. What they mean is that I’m not senile, or hysterical, or a rube. But these stereotypes are actually false,” Charlotte Cowles, a financial columnist for New York Magazine’s The Cut, wrote in her recent column.

The saga started on October 31 of 2023, when she received a phone call from a woman pretending to be a customer service representative for Amazon. The woman claimed to be calling to verify Cowles had made various expensive purchases on their website. After Cowles denied she had made these purchases, the woman told Cowles she was the victim of identity theft. She then proceeded to connect Cowles with a supposed official who was investigating fraud at the Federal Trade Commission.

After reading off her personal information to confirm her identity, this man went on to convince Cowles that her identity had been used by scammers to open nearly two dozen bank accounts and purchase multiple vehicles and properties. His story became more elaborate, as he claimed a car had been rented in Cowles’ name to commit multiple crimes. He provided photos to back up his claims and told Cowles there were warrants out for her arrest in Maryland and Texas and that she was being charged with cybercrimes, money laundering, and drug trafficking.

TV HOST ANDY COHEN SWINDLED IN COSTLY BANK SCAM: HOW TO AVOID BECOMING A VICTIM YOURSELF

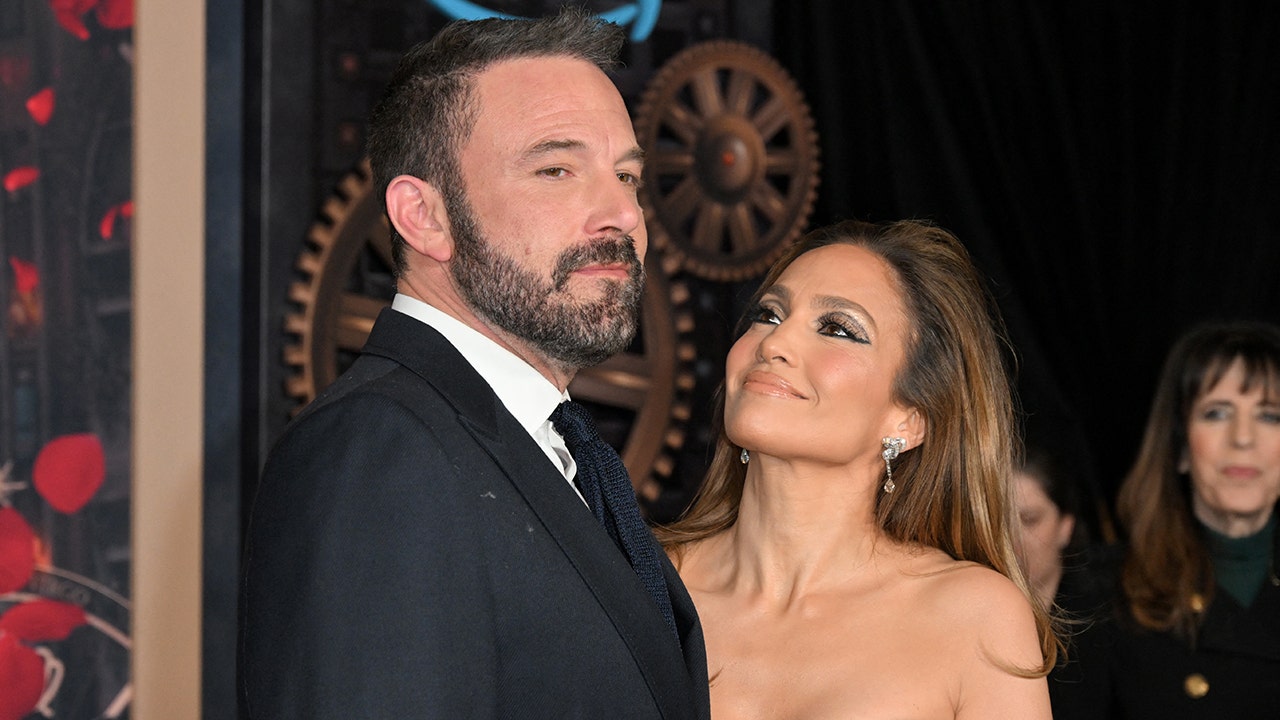

A financial columnist shared her Amazon scam horror story in her column this week for New York Magazine’s The Cut. (CyberGuy.com)

Although she could not find any information online to verify his claims, she was urged to keep this information to herself because her devices were likely being tracked by the hackers.

“If it was a scam, I couldn’t see the angle. It had occurred to me that the whole story might be made up or an elaborate mistake,” Cowles wrote in her column. “But no one had asked me for money or told me to buy crypto; they’d only encouraged me not to share my banking information. They hadn’t asked for my personal details; they already knew them. I hadn’t been told to click on anything.”

She was then asked to speak to a man claiming to be a CIA agent. He sent photos of his badge and pressured her to withdraw as much cash as she could from her bank account because her accounts would soon be frozen while they investigated her case.

Despite feeling both “terrified and absurd,” she followed through on the man’s request. He told her that she needed to give the cash to an undercover agent who would come to her apartment and that she would be issued a government check the next day because her assets were under investigation.

HOW SCAMMERS USE GOOGLE VOICE VERIFICATION CODES TO STEAL YOUR IDENTITY, MONEY

Charlotte Cowles explained the moment she realized she had fallen for a financial scam in her recent column. (CyberGuy.com)

Fearing for her own family’s safety, she complied even as she was feeling more and more unease with the validity of this story. Her fears were confirmed after the drop-off, when she was unable to connect with the agent who gave her his number.

“Now I know this was all a scam — a cruel and violating one but painfully obvious in retrospect. Here’s what I can’t figure out: Why didn’t I just hang up and call 911? Why didn’t I text my husband, or my brother (a lawyer), or my best friend (also a lawyer), or my parents, or one of the many other people who would have helped me? Why did I hand over all that money — the contents of my savings account, strictly for emergencies — without a bigger fight?” Cowles asked upon reflection.

While there’s a stereotype that older adults are usually targeted by scammers, a 2021 report from the Federal Trade Commission found that younger adults were actually 34 percent more likely to report losing money to fraud compared to those over 60.

The journalist admitted she was shocked to see how easy it was for her to accept the thieves’ promises and far-fetched stories, particularly since she is a journalist who covers finances and speaks to money experts regularly.

While she felt humiliated by the experience, Cowles learned that her story was not unique; at least 21 million Americans were scammed in2023, according to a recent survey byGallup.

Fox 2 reported last September that a Michigan woman lost $300,000 in a similar phone scheme after she was contacted by someone posing as a representative for Amazon’s fraud department and accused of drug trafficking.